FinTech Adoption and Financial Inclusion: Global Evidence

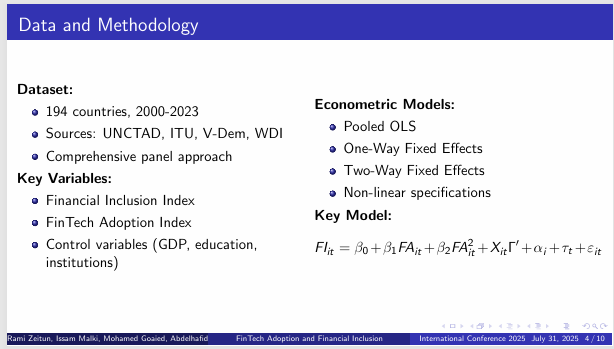

The presentation “FinTech Adoption and Financial Inclusion: Global Evidence” provides an empirical analysis across 194 countries between 2000–2023. The study reveals an inverted U-shaped relationship: while FinTech adoption initially expands access to finance by lowering costs and reducing barriers, diminishing returns appear at higher levels of adoption.

The COVID-19 pandemic further disrupted this pattern, accelerating digital uptake but weakening the inclusion impact. A key insight is that “more FinTech is not always better,” as optimal thresholds exist for maximizing benefits. The evidence also highlights regional diversity—advanced markets face plateau effects, while developing regions often experience stronger direct gains.

These findings offer important lessons for policymakers, regulators, and financial institutions: design strategies tailored to local contexts, ensure regulatory frameworks support inclusive adoption, and balance digital sophistication with the real needs of underserved populations. The session underscores how FinTech can drive sustainable and inclusive growth when guided by data-driven policy and global best practices.